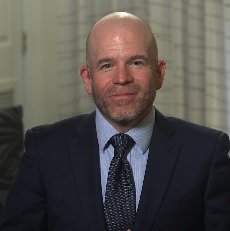

Matt Komos

Vice President, Financial Services Research & Consulting

TransUnion

Matthew Komos leads financial services research and consulting in the U.S. and is charged with providing insights and exploring emerging trends in consumer credit. He has over 20 years of experience in lending, with a focus on risk management, growth dynamics, customer profitability, and analytically derived solutions across the full consumer lifecycle. He also has extensive experience in the business lending arena. Komos has worked within and consulted for some of the largest financial institutions in the world, as well as various startup consulting and lending firms, where he’s leveraged empirically-based solutions to solve complex business problems.

Komos earned a bachelor’s degree in economics with a minor in mathematics from the University of Illinois at Champaign-Urbana, and a master’s degree in applied statistics from DePaul University. He’s a member of the Risk Management Association and teaches statistics at both the graduate and undergraduate levels.

Atsuko Watanabe

Senior Director of Research, Research and Consulting

TransUnion

Atsuko Watanabe leads the U.S. financial services research group for TransUnion. She has over 18 years of experience in financial services with primary focus on driving business transformation, growth and profitability in the credit card industry. Prior to joining TransUnion, she held key management positions at large, fast-growing companies involved in managing acquisitions, portfolio management and collections functions.

Watanabe holds a bachelor’s degree in mathematics, actuarial science, from University of Nevada, Las Vegas, and a master’s degree in mathematics, applied statistics, from University of Nevada, Las Vegas.